Weather news and local forecast

Glass account Opening Hours : Monday - Friday 8.30 am to 5.30 pm

Mongolian farmers plant wheat on about 70 percent of the country’s total arable land. Wheat is a national strategic product that has a significant impact on the country's food security and the employment of farmers.

Wheat crops have been severely damaged several times in recent years due to drought, as they are mostly irrigated by rainwater. Although the Agricultural Support Fund provides farmers with machineries, petroleum and seeds as support, and gives loans to increase farmers' productivity, climate change is posing a significant risk to Mongolia's agricultural sector. Between 1992 and 2006, the area without vegetation tripled, and plant biomass decreased by 20-30 percent.

Drought in 2015 was repeated in 2017. In 2017, around 77.7 thousand hectares of wheat was lost and the actual yield was 154.5 thousand tons less than the planned yield. Compared to the current market rate, the loss amount was about 85 billion MNT.

In 2015, Mongolia lost 45 percent of its wheat yield, and in 2017, 46 percent of the wheat due to overheating. Farmers who lost their crops become not able to cover their expenses. Therefore, they become not able to repay their loans from the Agricultural support fund. As a result of this, the domestic wheat supply declines, and creates problems everywhere.

Not only crop failure is a difficult situation for farmers, but also it is a burden on Mongolia's financial sector and any government support programs, as farmers become unable to repay loans, materials, equipment, and other loans they have received in advance. It reduces farmers' motivation to grow wheat in the future, also it makes it difficult for the farmers to obtain loans which eventually prevents the farmers to use good inputs and increase their productivity. Although we have a large area for wheat, the yield per hectare is much lower in comparison to other developed countries of the world.

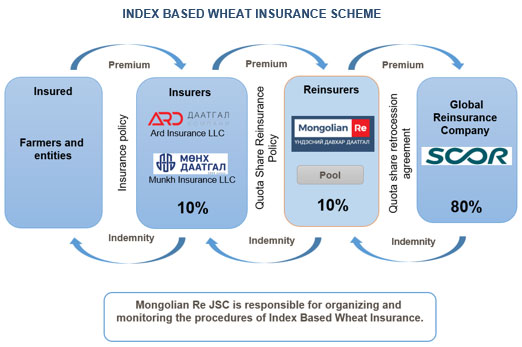

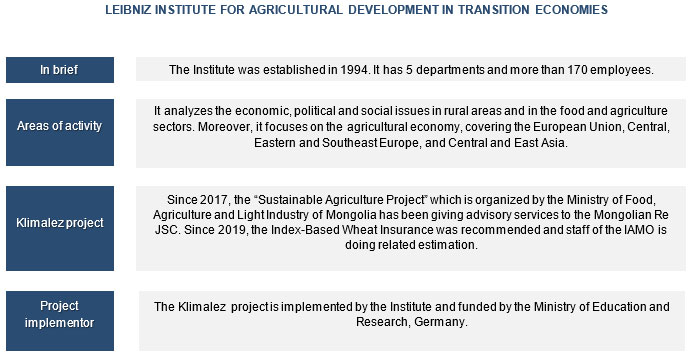

Therefore, the Mongolian Re state owned JSC is organizing the Index-Based Wheat Insurance based on modern advanced technology with the support of the Agricultural Support Fund. The insurance is designed in cooperation with the Leibniz Institute for Agricultural Development in Transitional Economies, Federal Republic of Germany.

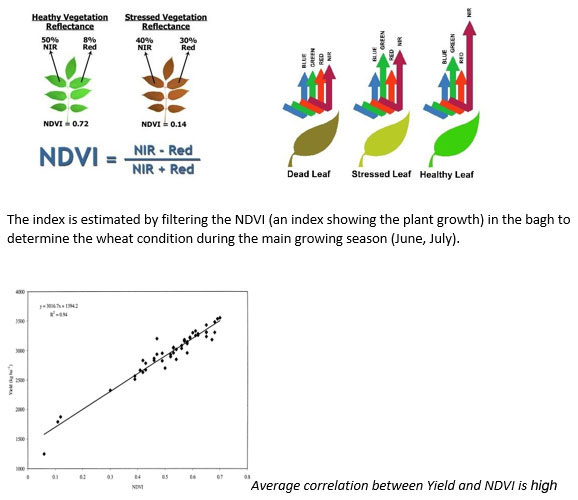

Index-Based wheat insurance is an insurance that indemnifies the insured farmer in the event of a decrease in the NDVI at the bagh (administrative unit) level during the insurance period, rather than the actual yield loss faced to the insured field.

AT THE MICRO LEVEL:

Insured farmers will be protected from significant financial losses due to yield losses.

Employment of farmers will be supported.

Farmers’ access to loans, grants and financing from banks and other programs will be increased.

AT THE MACRO LEVEL:

The level of national food security will improve.

Non-performing loans will be reduced.

Improved farmers' productivity will increase GDP.

The farmers will be insured against all kinds of natural risks in June and July which affect the growth of wheat such as the drought, the biggest risk. The NDVI is determined by natural risks that may affect the wheat yield in bagh (administrative unit) level.

If the farmer wants, he/she can choose:

Index Based Wheat Insurance does not cover the actual loss to the farmer's field. But when the NDVI in the bag level is decreased by 10 percent from the average NDVI in last 20 years, the insured will start receiving indemnity.

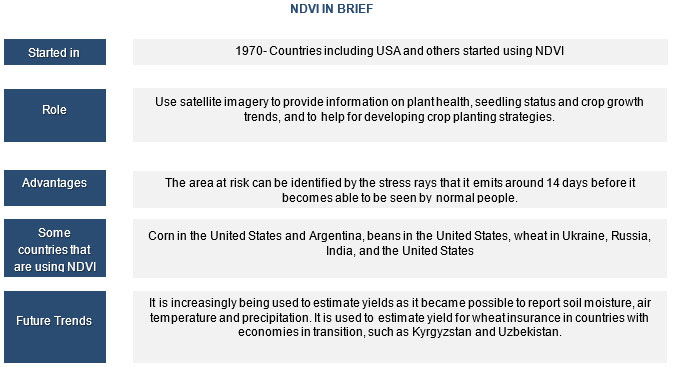

Satellite imagery of the rays emitted from the plants is used to determine the risks faced to the field. If the plant is healthy, the pink ray is emitted from the plant. But when the plant is in risk, the pink ray is decreased and red ray is increased. The NDVI increases as the plant is healthy and decreases as the plant is at risk.

The correlation between the wheat yield and the NDVI is high, as evidenced by a comparison of the historical data of each bag (the administrative unit) of Mongolia over the last 20 years. Therefore, wheat insurance based on the NDVI for each bagh can determine the amount of the wheat yield which the farmers received.

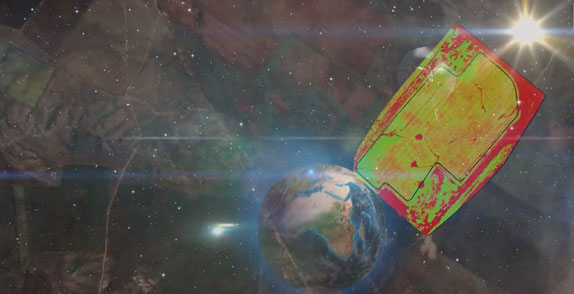

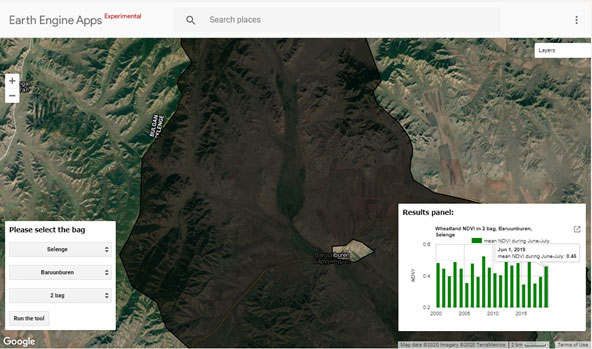

For this satellite imagery, the area with the best and healthiest growth is shown in red, and the area with the highest risk or lowest vegetation level is shown in green. The Leibniz Institute for Agricultural Development in Transition Economics, the Federal Republic of Germany, conducts loss assessment (estimates NDVI) basing on the vegetation data (NDVI) of the Bagh (administrative unit) collected by satellites for all the country level. The institute developed NDVI data platform for the Index-Based Wheat Insurance.

https://www.klimalez.org/klimastat/mongolia/

How the platform looks

Since the wheat is national strategic product, In 2016, the Mongolian Re JSC started implementing the traditional wheat insurance (Named Perils Wheat Insurance) in the pilot soums. In 2016-2019, the company received 196 million MNT as insurance premiums and paid 802 million MNT as indemnity payment.

Named Perils Wheat Insurance was time-consuming and not cost effective, therefore, premium was too high to prevent many farmers from buying the wheat insurance policy. As this insurance was not able to cover all farmers, based on our experience on Named Perils Wheat Insurance, we designed and organized the Index-Based Wheat Insurance in cooperation with the Leibniz Institute for Agricultural Development in Transition Economics, Federal Republic of Germany.

The Index-Based Wheat Insurance has following advantages:

SAVES TIME FOR CONDUCTING LOSS ASSESSMENT AND PAYING INDEMNITY

Index-Based Wheat Insurance saves time on conducting loss assessment and paying indemnity, since it does not require field inspections and is based on satellite data compared to traditional wheat insurance.

LOW OPERATIONAL COSTS

Insurance companies have much lower operating costs because there is no need for making field inspection to make loss assessments.

PREMIUM IS CHEAPER

Due to low operating costs, premium is cheaper. Therefore, it can reach more farmers.

EVEN IF THE FARMER’S YIELD WAS GOOD, HE CAN STILL GET INDEMNITY IF THE BAGH’S AREA IS GENERALLY IN DROUGHT.

The insured will get indemnity based on the drought conditions of the bagh level, not on the actual damage to the insured's field. This prevents from moral hazards.

FROST, COLD AND SNOW RISKS ARE AVAILABLE TO BE INSURED

The farmer can insure against the risk of frost, cold and snow in addition to Index-Based Wheat Insurance. The insurance premium is increased since the loss assessment is conducted in the traditional way by going for field inspection.

INSURANCE PREMIUM

Insurance premium amount depend on the level of yield loss risks for the bagh.

Insurance premium = Sum Insured* insurance premium rate

INSURANCE INDEMNITY

For the Index-Based Wheat Insurance, many stakeholders share the risk. Since the risk is transferred to international market, the indemnity payment is reliable even there is a great yield loss in the country level.

Indemnity will be paid basing on the amount of decrease in NDVI for the related bagh where the insured belongs.